Contingency fee law firms are usually founded by one or two partners. At the start, these founders will find themselves taking on all the business management roles necessary to keep the lights running while they litigate and bring in case fees. One partner may be better at marketing and client acquisition, while the other may find themselves more interested in running the daily operations.

The Importance of Running the Business Side of Law

As a firm grows, these operational responsibilities can be made official under the title of Chief Operating Officer or COO. The COO is essential in interpreting the law firm’s growth goals into digestible work plans and tasks for the firm’s different departments. Additionally, the COO supports the firm’s growth by effectively and efficiently managing the firm’s business operations. Without a competent COO, a law firm can easily become bogged down by its daily operations needs.

The Value of a Law Firm COO

The law firm COO can identify business areas ripe for change. For example, a COO may be able to spot an especially effective intake specialist, map out and analyze their process and help to develop a training program that can be scaled across the entire intake team. Law firm COOs should be excellent communicators, have high emotional intelligence and be extremely skilled at conflict resolution and negotiation. These attributes will help them prioritize which parts of the business need focus and lead department heads in implementing change to deliver the firm’s overall growth goals.

The Challenge of Funding a COO

Not all law firms may be able to afford a standalone COO, so this work usually falls on one of the partners. To ensure this partner has the time and resources to do their role well, law firms should consider reducing their litigation work, hiring a team to support them and hiring skilled litigators to pick up the cases the partner must forgo. Hiring talent is often a costly expense for growing law firms. At Esquire Bank, law firm clients often cite their inability to afford talented litigators as an obstacle to taking on more cases.

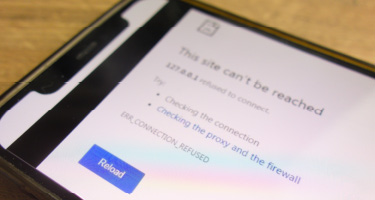

A COO could help a law firm determine where it can economize, increase productivity and streamline operations to find the cash to hire these coveted litigators. If the firm still comes up short, an adept COO could also suggest taking on financing, such as a Case Cost Line of Credit or a Working Capital Line of Credit.

Many of Esquire Bank’s clients have evolved from self-financing case costs to taking on a Working Capital Line of Credit once they saw how financing allowed them to scale the growth of their law firm and exceed their goals. Ensuring that the business of your law firm is running smoothly requires constant supervision and attention.

Interested in learning more about law firm growth strategies? Visit LawyerIQ

Learn more about how contingency fee firms are valued and how that affects the amount of financing a firm can potentially access by visiting lawyeriq.esquirebank.com.

The information provided in this blog is provided for general informational purposes only. Some of the information may not be applicable or appropriate for all law firms.