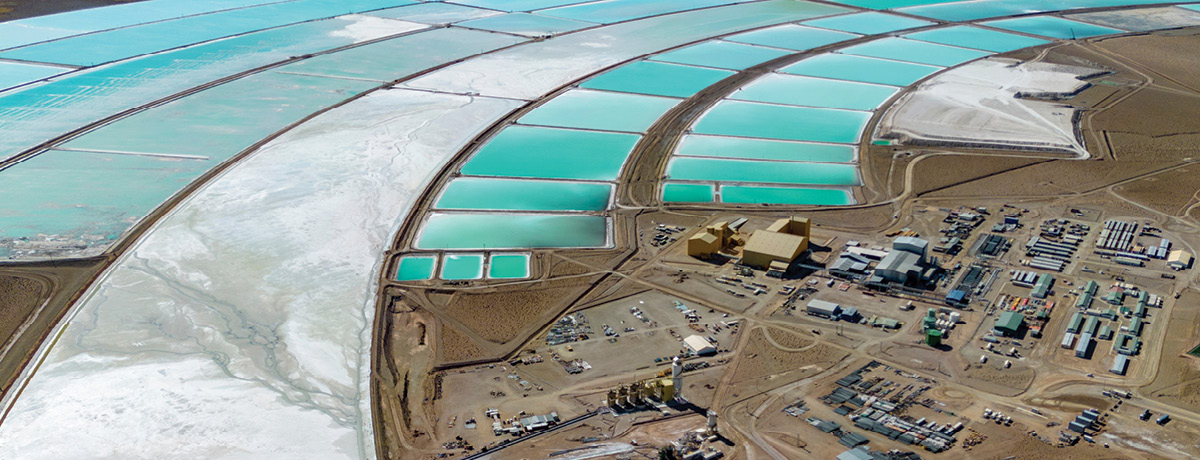

In a world racing toward a green future, the scramble for rare earth minerals is transforming the geopolitical landscape and stoking international tensions.

As global powers compete for green energy independence, pouring billions into mining the rare earth minerals crucial to meeting "net-zero" emissions targets, the legal and business path to achieving this future is littered with as many obstacles as opportunities.

The European Union's newly signed Critical Raw Materials Act signals a bold move to reduce energy dependency on China by ramping up the production of essential minerals needed for everything from clean energy to advanced computing.

As part of the European Green Deal signed in May 2021, the EU has turned the political ambition of reaching climate neutrality by 2050 into a legal obligation with its pioneering “European Climate Law” (Regulation (EU) 2021/1119). The law also sets an intermediate commitment of cutting net greenhouse gas emissions in the EU by at least 55% by 2030, compared to 1990 levels.

Experts say demand for raw material resources will surge over the next two decades if the EU meets Paris Agreement emissions standards. According to the International Energy Agency, if the EU can hit the emissions targets it adopted in December 2015, over the next 20 years, demand will rise more than 40% for copper and rare earth elements (REEs), 60-70% for nickel and cobalt and almost 90% for lithium.

The EU began listing raw materials crucial to the security of supply in 2011, allowing further EU action focused on the most relevant raw materials. There are currently 34 raw materials identified as “critical raw materials” (“CRMs”).

Out of these 34 CRMs, 17 are specifically listed as “strategic raw materials” (“SRMs”) for their importance in the clean technology sector. SRMs include inter alia lithium, nickel, manganese, titanium, platinum, cobalt, aluminum, copper and REEs.

Renewable energy use in the EU has skyrocketed in recent years. The share of renewable sources in gross energy consumption at the EU level reached 23% in 2022, up from 21.9% in 2021, according to the EU’s statistical office, Eurostat.

As the EU rushes to reach its ambitious emissions goals, challenges remain. While the EU seeks energy independence, it depends on importing many resources essential to achieving its emissions goals from countries like China, leading to high supply risks and complicating geopolitics. The EU also faces the decision of whether to invest billions to expand a nascent regional industry.

The EU said renewable energy sources accounted for 23% of its energy consumption in 2022, according to the European Parliamentary Research Service. The think tank found that a critical examination of the EU's energy scenario reveals that less than half of the energy needed to satisfy its domestic demand is produced internally. In 2022, the EU imported 62.5% of its consumed energy.

Reality Check

The EU suffers from a clear dilemma: while it aims for lofty emissions targets, it relies on third countries for the majority of its supply of CRMs. China provides a wide variety of CRMs, such as magnesium, and accounts for 85%-100% of the supply of REEs.

Other countries are also key suppliers to the EU for specific CRMs: Turkey for borate, Kazakhstan for phosphorus, Chile for lithium, the United States for beryllium, the Democratic Republic of Congo for cobalt and Guinea for aluminum.

As competition for rare earth minerals skyrockets, trade conflict and geopolitical tensions are following suit."

The U.S. also significantly relies on importing REEs. America imports 74% of its total REEs from China, according to data provided by the United States International Trade Commission.

Such a high concentration of supply from just a few third countries creates significant risks of supply disruptions for the EU, crystallized by competition for resources and geopolitical tensions.

Geopolitical Tensions Rising

Chinese authorities have implemented a series of restrictions on exports of REEs in the past, straining international relations. They have also recently reiterated limitations on exports of both REEs and associated technologies, stressing national security as their rationale.

China’s restrictions on exports of REEs have triggered disputes before the World Trade Organization, brought inter alia by the U.S. and the EU. On Jan. 30, 2012, and Aug. 29, 2014, the WTO’s Appellate Body considered that export duties and quota measures imposed by Chinese authorities on certain REEs breached WTO rules.

Recent years have seen a flurry of new standards from China surrounding exporting REEs. On Aug. 1, 2023, China restricted exports of gallium products, notably used for semiconductor chips.

Just two months later, on Dec. 1, 2023, China adopted new standards to require export permits for some graphite products, a key element for EV batteries and banned exports of REEs extraction and separation technologies and rare earth magnet production technologies.

On Sept. 15, 2024, China adopted export controls on antimony, a strategic mineral used for its properties of flame retardant and solar photovoltaic components.

As competition for rare earth minerals skyrockets, trade conflict and geopolitical tensions are following suit, with the U.S., in particular, on semiconductor exports.

The Biden administration imposed export controls limiting China’s ability to procure advanced chips in October 2022, with additional measures enacted in October 2023. According to the U.S., the limitations were designed to prevent China from receiving cutting-edge technologies that can be used to strengthen the country’s military and artificial intelligence (AI) sectors.

One of China’s first retaliatory moves has been to restrict exports of REEs that are essential for chip production. The current global circumstances have underscored the pressing need for both EU and European businesses to evolve and broaden their sources of Critical Raw Materials (CRMs).

EU’s 2024 Critical Raw Materials Act

On April 11, 2024, the EU finally equipped itself with a comprehensive instrument of public policy: the Regulation (EU) 2024/1252, or Critical Raw Materials Act, which establishes a framework for ensuring a secure and sustainable supply of CRMs.

Under the CRMA, efforts will be undertaken to moderate the expected increase in EU consumption of CRMs and to strengthen the different stages of the SRMs value chain (the sub-category of CRMs with a specific importance for the clean technology sector).

The CRMA sets the following targets for 2030 in relation to SMRs: approaching or reaching an EU extraction capacity of at least 10% of the EU’s annual consumption, an EU processing capacity of at least 40% of the EU’s annual consumption and an EU recycling capacity of at least 25% of the EU’s annual consumption; and ensuring that not more than 65% of the EU’s annual consumption of each SRM at any relevant stage of processing is sourced from a single third country.

Besides the Commission, EU Member States and certain large manufacturing companies using SRMs are required to reinforce monitoring tools. For instance, certain companies—which shall be identified by Member States by May 24, 2025—will have to carry out at least every three years a risk assessment of their SRMs supply chains and improve their mitigation strategies in the event of a supply disruption.

Pursuit of Partnerships

Strategic partnerships with various and reliable third countries are crucial to diversifying the sources of CRMs imports.

A number have been signed to date: Canada and Ukraine in 2021; Kazakhstan and Namibia in 2022; Argentina, Chile, Zambia, the Democratic Republic of Congo and Greenland in 2023; and Rwanda, Norway and Uzbekistan in 2024.

On May 28, 2024, the EU signed a Memorandum of Understanding on sustainable critical and strategic materials with Australia, which supplies 6% of the world’s rare earth mining production.

Domestic Supply Chain Crucial to EU Success

The EU needs to develop a domestic industry, from the extraction of CRMs to the manufacturing of clean technology equipment.

Meeting the 10% extraction target implies the availability of EU geological resources and relies on the effective development of extraction projects on identified areas. New mines have recently been discovered in the EU, including a site in Kiruna, Sweden, with a potential of more than a million tons of REEs, and a site in south-western Norway, where significant deposits of phosphate rocks, vanadium and titanium have been discovered.

The legal and business path to achieving this future is littered with as many obstacles as opportunities."

Whether such extraction sites will suffice remains uncertain. Member States must draw up national programs for general exploration by May 24, 2025.

Industrial projects of public interest that specifically contribute to ensuring a secure supply of SRMs will soon benefit from an attractive legal framework as “Strategic Projects.” The CRMA requires Member States to reduce their administrative burden and limit delays in their permitting processes. In turn, they will be subject to reporting obligations. Any project promoter can apply; the first call for applications was from May to August 2024.

Recycling and Innovation Are Key

For the last several decades, the EU has implemented ambitious waste recycling and recovery policies promoting circularity and focused on extended responsibility of the waste producer schemes (“EPR”) for electrical and electronic equipment and batteries used in the EU.

Existing efforts will now be targeted on CRMs. Under the CRMA, incentives for technological progress and resource efficiency are expected from Member States to increase the re-use, repair and recycling of products with CRMs recovery potential.

The CRMA labeling obligation requiring certain operators to affix a label indicating the incorporation of permanent magnets and publish the share of REEs in the composition of their products will improve consumer information. From Aug. 18, 2025, operators must also carry out a battery due diligence to identify and address the risks linked to using raw materials under the new Battery Regulation (Regulation (EU) 2023/1542).

Yet technical difficulty to recycle depends on the concerned material. Although certain CRMs have a high recycling potential—roughly 50% of EU copper demand comes from recycled sources—recycling is highly challenging for others, in particular REEs given their tiny quantities in complex products (their current recycling rate is less than 1%).

Achieving the 25% recycling capacity target for SRMs will consequently require important R&D efforts for processes and eco-design. Programs to support innovative projects are being launched at EU and domestic levels.

R&D on alternative options reducing the use of SRMs or using substitutes must be complementary. The International Energy Agency highlights promising perspectives within the next decades, such as the use of high-temperature superconductor (HTS) in permanent magnets incorporated in wind turbines to reduce REEs consumption in the manufacturing process, and the development of less intensive silicon and silver photovoltaic modules.

What Are the Costs?

Scaling a domestic CRMs supply chain comes at a cost. Beyond environmental matters regarding soil protection and waste generation, and foreseeable opposition from local communities and environmental organizations, the development of industrial projects requires massive investments.

The EU, together with the European Bank for Reconstruction and Development (EBRD), launched on July 31, 2024, a joint facility providing equity investments for the exploration of CRMs, with contributions amounting to a total of €50 million. The joint facility aims to leverage another €50 million.

The EBRD will invest in 5 to 10 junior mining companies that undertake CRMs exploration in eligible countries, operating responsibly in compliance with environmental, social and governance standards.

More investments will be crucial. The U.S. Inflation Reduction Act (IRA), signed Aug. 16, 2022, provided $10 billion in funding for the Section 48(C)(e) Qualifying Advanced Energy Project Credit Program, which supports investments in facilities and projects in the U.S. involving clean energy products and reducing greenhouse gas emissions at industrial facilities.

The U.S. granted another $4 billion in projects in March 2024 for over 100 projects in the U.S., including a $58.5 million tax credit awarded to the operator of the Mountain Pass, North America’s only mine of REEs, to construct a rare earth magnet manufacturing facility.

The site, which now supplies around 15% of global rare earth mining production, had already been awarded a $35 million contract by the U.S. Department of Defense to design and build a facility to process heavy REEs.

Navigating the Path to Climate Neutrality

These strategic moves by global powers don’t just affect international law and business—they set the stage for a new era of industrial policy and trade restrictions that could dictate the pace of innovation and security in the 21st century.

The EU’s capability to achieve its climate neutrality objective in a globalized and unstable market requires the development of local production of clean technologies, which will remain wishful thinking if the security of CRM imports is not ensured, coupled with a reduction of their use and an increase of their recyclability.

The EU will need to navigate a complex geopolitical context, develop reliable partnerships with international allies, gather financial resources to fund necessary R&D efforts and help the development of strategic projects both within and outside the EU.

Massive investments will be crucial to improve the competitiveness of European companies and to capitalize on the EU’s strengths in cutting-edge projects. Progress toward the SRMs targets for 2030 will be monitored by the Commission by May 24, 2027, and will provide feedback on the level of implementation and relevance of the CRMA’s measures.

In the meantime, businesses need to prepare for the implementation of new labeling and reporting obligations regarding their products’ supply chain and use of CRMs.

Maryne Gouhier is a senior energy and environmental lawyer at Bryan Cave Leighton Paisner (BCLP) – Paris office. She assists companies in the industrial, renewable energy and logistics sectors with the development of their projects regarding regulatory and transactional matters. She has developed a particular expertise in EU product law, ESG requirements and innovative projects.

Armelle Royer is a senior associate at Bryan Cave Leighton Paisner (BCLP), admitted to the Paris and New York bars. Her practice is primarily focused on corporate law and mergers & acquisitions. She advises investment funds and listed and unlisted companies on their domestic and cross-border mergers, acquisitions and joint venture projects. Her recent experience includes transactions in the energy and new technology sectors.