In today’s constantly changing legal landscape, a growing trend that has prevailed as an industry mainstay over the last few years is environmental, social and governance criteria, or ESG. ESG criteria is a set of industry standards for a firm or company to uphold in order to remain socially conscious. As of late, the viability standards used to rate the top law firms in certain states almost always start and end with ESG.

Often utilized by outside investors screening a firm’s overall practices, ESG criteria focuses on three major aspects of operation: how a firm expresses concern and advocacy for the environment; how it manages and navigates relationships with associates, clients and their community; and how its leadership governs or organizes operations to ensure the firm runs smoothly.

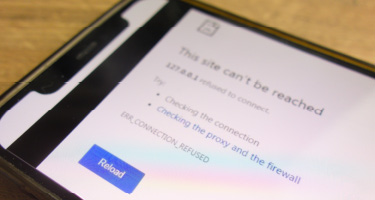

One state in particular that has seen a massive recent push for ESG criteria, specifically in the environmental area, is Texas. In September 2021, the Texas State Senate passed SB13, which now prohibits Texas-based firms from contracting with or investing in companies that divest from the oil, natural gas and coal energy industry. This legislation defines the term “divestment” as refusing to maintain business or represent a fossil fuel company actively operating outside the expectations of state and federal law. With the oil and natural gas sector accounting for nearly 10% of Texas’s gross domestic product, SB13 will more than likely limit the prospect of future business for corporate firms as well as effect the overall economy of the state.

Apart from the growing environmental push for ESG criteria, Texas state legislators are beginning to focus on evaluating the social aspects of the state, including its pension funds for public school, college and university employees. The Teacher Retirement System of Texas, which is among one of the largest institutional investments for the state, approximately held $200 billion in assets as of 2021.

These drastic changes to the Texas legal landscape arrived just a year shy of Governor Abbott’s attempt to pass anti-ESG legislation, presumably meant to thwart off the now successful SB13. With Texas-based lawyers bracing for further pushbacks and major organizations begin to boycott ESG funds, firms will likely face a bevy of unknown challenges ahead as state legislation still needs to be ironed out.