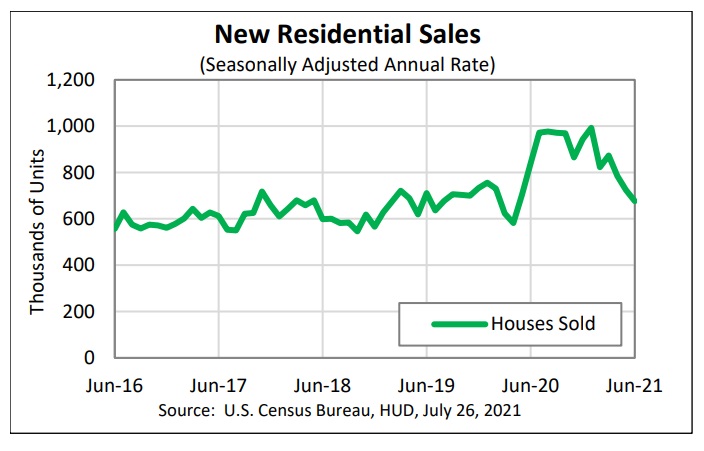

The housing boom that we have experienced for the past year is slowing down. In fact, sales of new homes decreased in June to the lowest level since the early days of the pandemic in April 2020, according to the U.S. Census Bureau. Sales of new single family homes decreased to 19.4% below June 2020 levels, and are 6.6% of May’s rate. While the median price of a newly built home in June rose approximately 6% from June, 2020, it is significantly less compared to the 15%-20% annual gains seen in previous months.

What happened to the housing market?

During this past year, home prices remained incredibly strong due to increased demand and low supply. While mortgage rates were at record lows, enabling more and more of us to purchase homes, many remain locked out of home ownership because they are unable to afford homes as they either do not have a down payment or their income does not qualify them for a mortgage as housing prices continue to rise.

Yet, while residential purchasing on the higher end of the market remains strong, the fact remains that there still is not a lot of affordable homes on the market. One reason for this is the skyrocketing construction costs, especially in lumber which has spiked more than 300% during the pandemic—which is still 75% more than its 2019 average. As a result, builders are unable to build affordable homes. Further, shortages of labor and appliances are adding to delays in homebuilding which, in turn, causes prices to rise. As builder analyst Ivy Zelman indicated, “We are shifting our tone on the housing market based on our analysis of proprietary data showing early signs of a cool down.”

Another major reason for the housing slowdown is that purchasers in June faced higher mortgage rates, which rose to nearly a quarter of a percentage point. For some purchasers who were already stretched by increased home prices, higher interest rates preclude some from purchasing as they have less of a financial cushion to do so.

What is next?

The question remains: is the issue the affordability of new housing or increased pricing attributable to labor shortages and increased builder costs causing the housing market to start cooling? The answer: both. There are always market factors—increased financing costs, supply and demand—that are attributable to the ups and down of the real estate market in general. And, while inventory for new homes for sale jumped from 5.5-month supply in May to a 6.3-month supply in June while last fall, the inventory was a low of 3.5 months, there is a divide of those who can afford the homes and those who can not.

We may agree that having such a strong real estate market as we have experienced during this past year is not sustainable. Markets rise and fall. And, at least for now, the pundits believe that the housing boom of the COVID-19 pandemic has begun to soften.

Should you have any questions or need assistance with a residential real estate purchase or sale, our title company, Weston Title & Escrow, Inc. is able to help you. Should you have a legal questions about a potential purchase or sale or another legal matter, our team at Oppenheim Law is here for you.

Roy Oppenheim

From the Trenches