As the Federal Reserve raises interest rates for the second time in a few short weeks, supply chain issues still abound, and inflation continues to roar, what does this all mean for the real estate market in South Florida and to you?

Adjustable Mortgages and Home Prices

To begin with, if you have an adjustable-rate mortgage you will likely see a big jump in your monthly payment if your adjustment is coming up in the next few months. Many folks will not be able to sustain such a big jump and will likely have to sell their homes creating more inventory in the marketplace. Further, new fixed rate mortgages will be at about 6 percent— almost double what they were just a year or 18 months ago. These increased rates will also put a damper on the demand side of the market preventing many people from qualifying for a mortgage, forcing existing homeowners to realign their selling prices to the weakened demand in the marketplace.

Cash, Employment, and Lenders

Cash buyers will nevertheless be able to have less competition from folks needing a mortgage and will be able to begin the process of negotiating prices downward. Should a recession hit, as it is now predicted, we will see retailers reducing prices and employers slashing payrolls. This actually has already begun in various sectors including the mortgage industry, ad sales, crypto, and even large law firms. Less people employed, who either rent or have mortgages, will impact the real estate market as they unfortunately will need to eventually move if they are unable to find employment. Some may be foreclosed. Should this all happen, or should we say WHEN, real estate will join the other asset classes of stocks, bonds and crypto that have seen the air seep out of their respective inflated bubbles. Until now, professional investors in the stock market loved to say there is no alternative to investing in stocks ( euphemistically called TINA) while others have felt that way about real estate too.

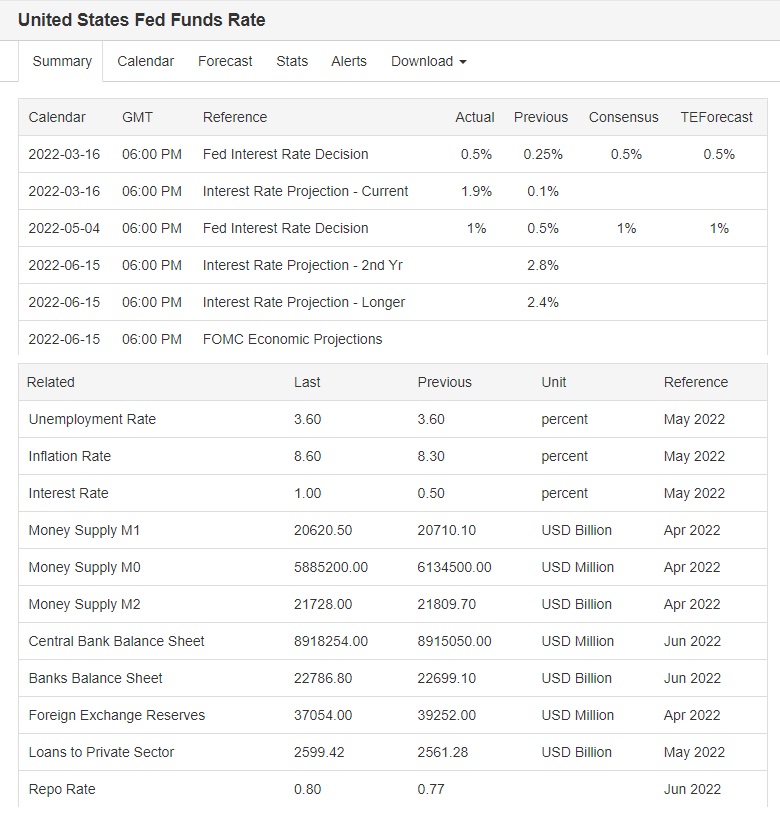

Source: tradingeconomics.com | Federal Reserve

What does this all mean?

Despite the foregoing, one thing I learned over 30 years in real estate is that South Florida in particular works in a boom to bust cycle and yet coming correction may not be as bad as the last one 14 years ago. Why? Back then, many people had used second mortgages to assist with expenses, and lenders and regulators took a blind eye to the fact that many people would eventually default. This is not the case presently.

While we do not wish to predict turbulent times ahead, the real estate market is in flux. For the past thirty plus years both Oppenheim Law and, our sister company, Weston Title will once again be there to assist you with guiding you throughout.

From the Trenches,

Roy Oppenheim

posted first at: https://southfloridalawblog.com/the-effects-of-rising-interest-rates-and-south-florida-real-estate/