With increased mortgage interest rates, many sellers are debating whether to sell their homes. These sellers face the same issue as many potential home buyers: pressure from rising interest rates. Why? Unless a seller obtains a cash buyer for their property, many home buyers may not be able to afford the home they wish because of increasing interest rates.

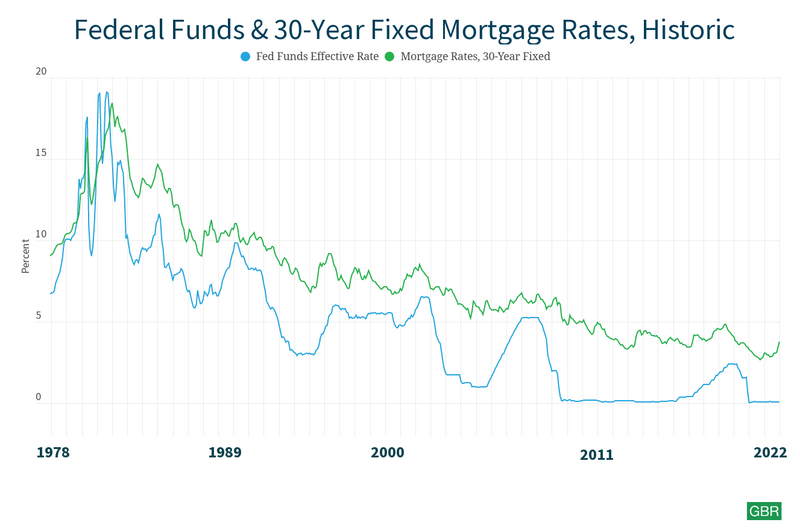

In addition to a decrease of home buyers being able to obtain financing due to increased mortgage rates, sellers with mortgages are currently locked into lower mortgage rates and reluctant to move, especially if they do not have to. A chief economist for Freddie Mac indicated that home sales decrease when mortgage rates are more than two percentage points higher than a buyer’s current rate. In 2021, many buyers locked in a rate around 2.6% when mortgage rates were low; however, now those interest rates are almost at 7%.

Change of Attitude

While the total amount of homes on the market remains higher today than a year ago, new homes coming to the market are on the decline. In fact, there is a 22% drop in new listings coming to the market in South Florida, demonstrating a shift in some seller’s attitudes towards listing their property. In May of this year, prior to the rise of interest rates, many sellers tried to sell their homes before the rates discouraged home buyers from purchasing. In May, it is reported that 72 homes per week came on to the market in Ft. Lauderdale; by October, the number of homes coming to the market per week was 49. This shift illustrates how the overall housing market for both buyers and sellers have changed. Unless home sellers rent, sellers become buyers and are faced with the same rising interest rates. Instead, if a seller currently is locked into a 3% interest rate, that seller may not wish to buy at the current rates even though there is an option to refinance later.

How Mortgage Rates Are Impacting Sellers (picture courtesy GOBankingRates)

Contributing factors to the market slowdown is home buyers wary of purchasing with rising mortgage rates and high prices, and sellers wary of losing their current low interest rates. As we indicated in an earlier blog, the housing market slowdown illustrates that the booming housing market which began during the onset of the pandemic continues to wane.

What does this all mean?

The housing market continues to be in the process of a correction. Rising interest rates are just one factor that has changed the mindset of not only buyers but also sellers. At some point, interest rates will reach their peak at which time the South Florida real estate market will likely see an increase in foreclosures and distress sales. When that happens, the market will readjust into an equilibrium where prices will adjust to meet buyer demand.

Oppenheim Law

2500 Weston Rd #209

Fort Lauderdale, FL 33331

954-384-6114

https://www.oppenheimlaw.com

Originally posted at: https://southfloridalawblog.com/why-are-sellers-reluctant-to-sell/