It might seem like just yesterday that employers were told that they needed to use a new version of the Form I-9, the document verifying the identity of new hires to ensure they are authorized to work in the United States. Yet just eight months after the release of the most recent version, the United States Citizenship and Immigration Services (USCIS) has today released an updated Form I-9. Employers will need to adapt to the change and use the new form by no later than September 18, 2017 or face the possibility of large fines.

Changes to the Form I-9 Are Subtle

The new version brings very subtle changes to the form’s instructions and list of acceptable documents, which were created with the theoretical goal of making the form easier to navigate. Besides changing the wording on the form in almost imperceptible ways (for example, removing “the end of” from the phrase “the first day of employment,” and asking for “other last names used” rather than “other names used”), the new version renumbers all List C documents except the Social Security card, and streamlines the certification process for certain foreign nationals.

Some other subtle changes include the addition of prompts to ensure information is entered correctly, the ability to enter multiple preparers and translators, the creation of a dedicated area for including additional information rather than having to write information in the document margins, and a supplemental page for the preparer or translator to complete.

You are unlikely to notice these changes without a close comparison to the soon-to-be-outdated document. The easiest way to be sure you are using the new version is to examine the “revision date” printed on the bottom of the form. The previous version of the form, released in November 2016 and required to be used as of January 2017, will contain a notation on the bottom of the page informing you that the document was created “11/14/16 N.” The new version now states “7/17/17 N.”

Best Practice: Begin Using New Form Immediately

Although you will be able to use this new version or continue using the previous Form I-9 through September 17, 2017, it makes sense to scrap the use of the November 2016 version and begin using the updated version right away. You should recycle all older versions you already have printed out, and instruct your hiring managers and human resources representatives to download newer versions of the form for use with new hires from this point forward. On September 18, 2017, all employers will be required to use the revised form, so it makes sense to avoid any delay and begin use of the new version immediately.

Consequences of Non-Compliance Can Be Costly

Although the changes to the Form I-9 are slight, failure to use the new form and comply with the Form I-9 by the September 18 deadline can result in large fines. Just last year, Immigration and Customs Enforcement (ICE) announced increases in fines for Form I-9 violations to account for inflation. These increases are as follows:

- Simple Form I-9 violations: The minimum fine has increased from $110 to $216 per Form I-9 violation, while the maximum fine increases from $1,100 to $2,156 per Form I-9 violation. Fines for second and third offenses have also increased to a similar degree.

- Unlawful Employment of Unauthorized Workers: For the first offense, the minimum fine has increased from $375 to $539, while the maximum fine increased from $3,200 to $4,313 per worker (fines for second and third offenses also increased).

- Unfair Immigration-Related Employment Practices: The minimum penalty has increased from $375 to $445, while the maximum penalty increased from $3,200 to $3,563 per charge. Repeat offenders now face a new maximum penalty of $21,563.

While the rule to increase the fines took effect on August 1, 2016, the increase to Form I-9 fines were retroactive to cover any violations that took place after November 2, 2015. Our firm has already defended cases where small employers with fewer than 100 employees faced potential fines in excess of $100,000 for simple errors.

Conclusion

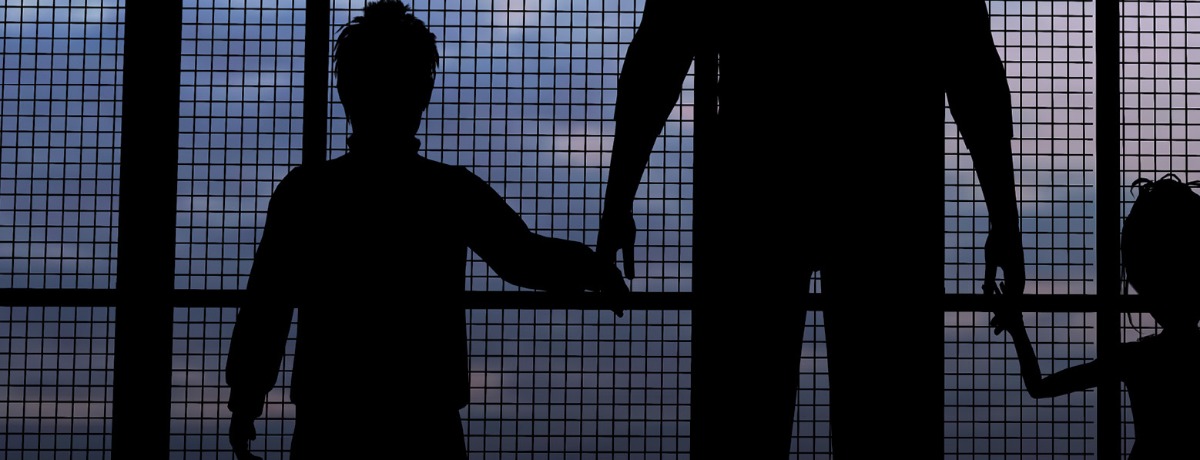

It is unlikely that the Trump administration will slow down these employer-driven immigration compliance mechanisms. Based upon early actions from the administration to increase enforcement and hire more ICE agents, it is increasingly likely employers will face enforcement actions in the form of ICE audits, workplace raids, and employee deportation.

We will continue to monitor the status of all immigration-related activity, including further executive actions, and ongoing and future litigation, and publish updates as additional actions are taken, or information is provided, by the federal immigration agencies, the White House, and the judicial system. Please be sure to regularly review our Cross Border Employer Blog for updates about these and other developments.

If you have any questions about these developments or how they may affect your business, contact any member of our Global Immigration Practice Group, or your regular Fisher Phillips attorney.