What Constitutes Bad Faith Insurance Practices?

When an insurance company acts in bad faith, it means the insurer is not fulfilling its contractual obligations to the policyholder. An insurance policy is a contract that carries certain obligations for the parties to the contract. You will need a copy of the policy and proof that you are up to date on the payment of premiums. Since insurance companies prepare the policy contracts and control the settlement of claims, policyholders are at something of a disadvantage. It’s important that the insurers deal fairly with policyholders when they have claims. The specific laws on what constitutes bad faith insurance practices vary from state to state. A policyholder who has been harmed by an insurance company’s bad faith dealings in claim settlements may be entitled to take legal action and seek compensatory damages, and in some cases punitive damages. Your bad faith claim may be worth more than the value of your underlying insurance policy.You generally have to prove two things if you believe an insurer acted in bad faith. Those two elements are:

- The insurance company denied you the money you are entitled to under your policy — Insurance companies expect policyholders to abide by the terms of their policy, but that expectation goes both ways. If an insurance company does not provide you the benefits you are due according to your policy, they may be acting in bad faith.

- The insurance company’s justification for denying your benefits is unreasonable — Insurance companies can deny claims if they have a valid reason. However, insurers have been known to deny claims for invalid reasons. If this happens, the insurance company is acting in bad faith.

Examples of bad faith insurance practices

There are many tactics that insurance companies engage in that may constitute acting in bad faith. Some common examples are:

- Denying your claim without giving you a reason

- Failing to investigate the claim in a prompt manner

- Unreasonably delaying or denying a decision on a claim

- Delaying or denying requests for approval of medical treatment

- Not paying a valid claim

- Threatening a policyholder

- Misrepresenting the terms of a policy or the insurance laws for your state

- Delaying payment of valid claims

- Offering less money for a claim than it’s worth

- Denying reasonable requests for documents related to a claim

- Putting profits ahead of a policyholder’s valid claim

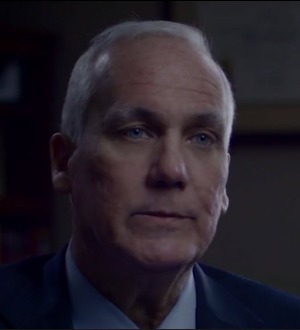

Contact our experienced bad faith insurance attorneys today

The car accident lawyers at Craig, Kelley & Faultless, LLC, have extensive experience dealing with insurance companies. We have over 20 years of experience helping accident victims stand up to insurance companies and demand fair compensation for their injuries. If you think your insurance company is acting in bad faith, contact us today for a free initial consultation.