The shift away from shareholder primacy toward so-called “stakeholder” governance has been the subject of intense discussion not only in boardrooms but also throughout academia, regulatory agencies and national legislatures. The traditional Milton Friedman doctrine of shareholder primacy has been eroded to some degree by the new stakeholder paradigm, as codified in the 2020 Davos Manifesto, “The Universal Purpose of a Company in the Fourth Industrial Revolution.”

This transition has been decades in the making, with companies now increasingly considering environmental, social and governance issues (ESG), as well as sustainability and long-term growth. Viewed through this lens, the fundamental purpose of for-profit corporations—and, accordingly, the decision-making calculus of their boards—must include value creation. Companies do not exist in a void, after all, but in a complex ecosystem of stakeholders. These days, it’s essential that a corporation consider its commitment to those stakeholders’ values—and, in parallel, that executives speak up for responsible, sustainable development and the rule of law. In times of global crisis, amplified by the megaphone of social media, companies no longer have the option to sit on the sidelines.

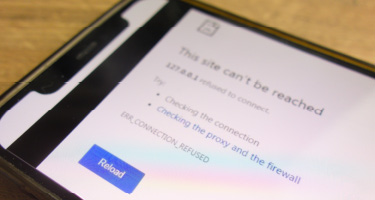

Consider the recent worldwide spike in energy prices, for example. It offers important lessons, underscoring the need for debate about a nondisruptive transition to a low-carbon world and less dependence on imported fossil fuels. Major countries’ commitment to an accelerated path toward climate neutrality will be the most effective instrument to stimulate economies, reduce energy costs and avoid energy security problems down the road. However, current global instability, with protectionist measures on the rise and geopolitical tensions exacerbated by Russia’s invasion of Ukraine, make this an inauspicious moment for multilateralism. Under these circumstances, where the incentive for a global and coordinated response is undermined, and the legal security required by private sector is challenged, the contribution of the private sector, its commitments and business decisions—as a global actor—will be more than ever a key indicator on how successful we are on addressing the climate change global challenge.

Bearing in mind that in the short-term Europe will not be able to reduce its energy dependence on others, Europeans are nonetheless obliged to diversify their resources to guarantee steady supplies. In the mid- and long term, however, the solution must be self-sufficiency through the transition to cleaner energy, though this will require considerable investment over many years. As such, global corporations need to commit to addressing the challenge of climate change.

Business leaders and investors across Europe have endorsed the ambitions of the European Green Deal."

Global and local climate targets, typically tied to goals ideally achieved by 2030 and 2050, necessitate greater private investment in renewables, which will reduce greenhouse-gas emissions and contribute significantly to the fight against climate change. At the national level, renewables will help guarantee price stability and promote energy independence, making future supply crises less likely.

All this helps explain why companies committed to ESG and stakeholder capitalism have a major role to play. Business leaders and investors across Europe have endorsed the ambitions of the European Green Deal; in a recent open letter with more than 200 signatories, companies including Microsoft, IKEA, Iberdrola, Unilever and Deutsche Bank outlined their determination for a climate-resilient global recovery.

For the European Union, meanwhile, the most effective way to achieve energy self-sufficiency is to accelerate the transition in every dimension: increasing the use of renewables, promoting energy efficiency and improving new technologies, in particular green hydrogen. These objectives underlie the European Commission’s REPowerEU plan, unveiled this May, which reinforces the objectives outlined in the “Fit for 55” communiqué, under which the EU will reduce its net emissions by 55% by 2030.

The rise in energy prices is a great cause for concern, and a major challenge to the energy transition process. Businesses and governments alike must implement corrective measures without jeopardizing the progress already made. The European energy market, studies show, has worked very effectively, particularly for encouraging investment in renewables. The current problems are a result of rising gas prices; they must be solved with specific measures, in particular toward vulnerable sectors, like families, households, small and medium-sized enterprises, the self-employed and, very importantly, industry.

Europe began its energy transition two decades ago and has already achieved important results, notably the fulfillment of the objectives set for 2020 and the positive forecast for those of 2030. The EU has the world’s most complete set of legislative tools and financial instruments to decarbonize by 2050. Although the current crisis presents significant risks, Europe unquestionably has the capacity to overcome them and accelerate this critical process.

Javier Cremades is a Spanish attorney, founder of the international law firm Cremades & Calvo-Sotelo and President of the World Jurist Association. Javier is a regular speaker and commentator at law seminars and conferences pertaining to his field of expertise.