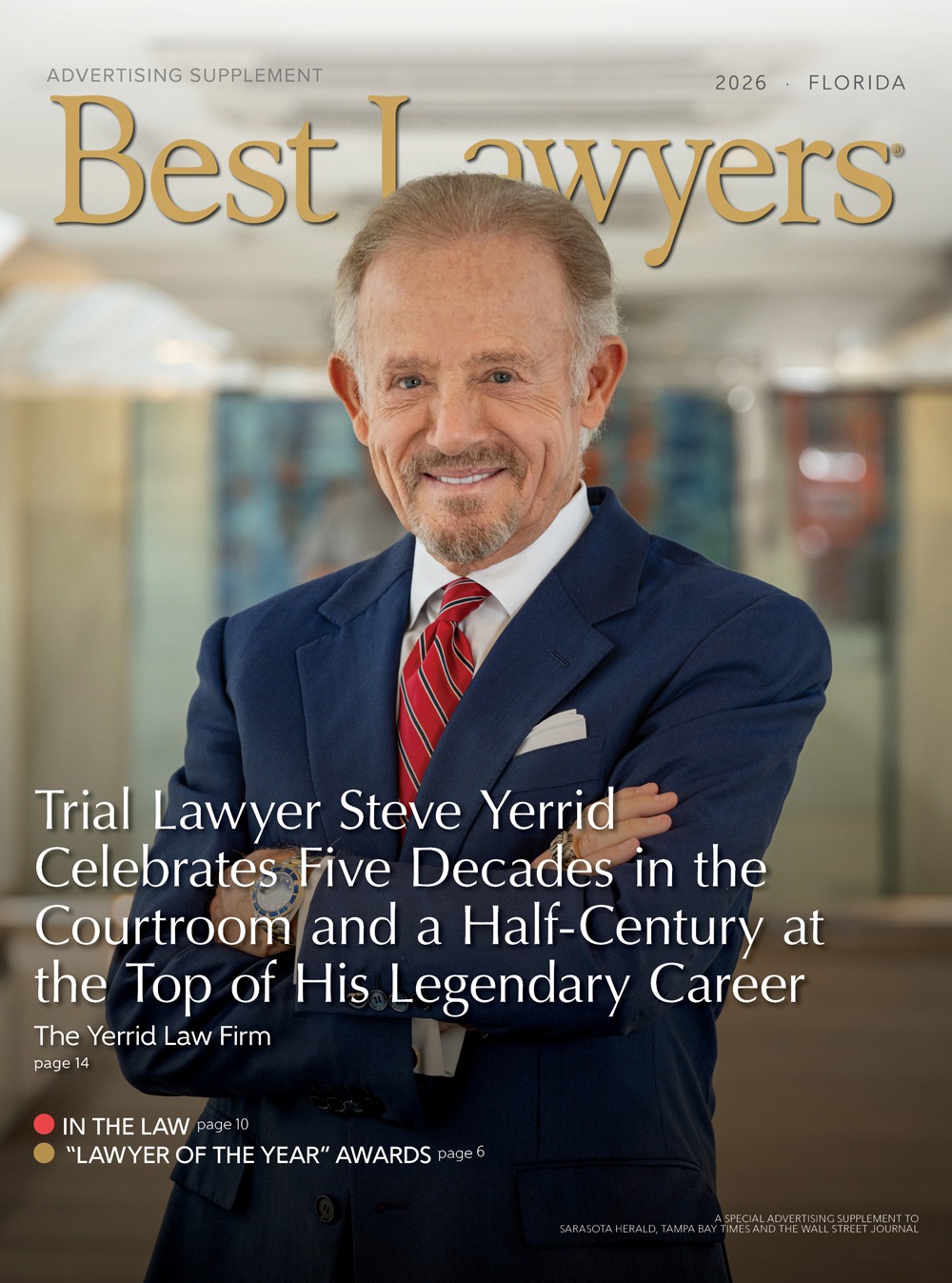

Lauren A. Taylor

Firm

1 Best Lawyers award

Awarded Practice Areas

Biography

Lauren has spent her career working closely with high-net-worth individuals and business owners to structure their estate plans and business holdings in a tax and administratively efficient manner. She designs and implements sophisticated wealth transfer strategies to maximize the protection of her clients’ wealth for generations. Lauren’s wealth preservation practice includes minimizing federal income, estate, gift, and generation-skipping transfer taxes, business succession planning, charitable planning, private foundations and tax-exempt organizations, and prenuptial and postnuptial agreements. Lauren represents personal representatives, trustees, and beneficiaries in estate and trust administration and litigation, estate and gift tax return preparation, irrevocable trust modification and termination, and post-mortem estate planning.

Firm

1 Best Lawyers award

Overview

- University of Florida, Finance, graduated 2008

- University of Florida, J.D., graduated 2011

- Florida, The Florida Bar, 2011

- Florida, The Florida Bar, 2011

- University of Florida, Finance, graduated 2008

- University of Florida, J.D., graduated 2011

Client Testimonials

Awards & Focus

- Closely Held Companies and Family Businesses Law

- Litigation - Trusts and Estates

- Tax Law

- Trusts and Estates

News & Media

Your browser is not fully compatible with our automatic printer friendly formatting.

Please use the print button to print this profile page.