Closely Held Companies and Family Businesses Law Litigation and Controversy - Tax Tax Law

William B. "Bill" Sherman

Awarded Practice Areas

Biography

William B. Sherman is a partner in Holland & Knight's Fort Lauderdale office. Mr. Sherman serves as chair of the firm's Tax Team and concentrates his practice in the area of domestic and international taxation. He has provided sophisticated tax planning for mergers and acquisitions, restructurings, joint ventures and investments for clients in diverse industries, such as hospitality, petrochemicals, aluminum, tobacco, real estate, transportation, telecommunications, retailing, investment management, pharmaceuticals and numerous others. In addition, Mr. Sherman has experience in a broad range of transactions involving United States investment overseas, foreign investment in the U.S., as well as international, federal, state and local taxation issues involving structuring investment management funds, corporate reorganizations, partnerships, equipment leasing, Subchapter S, executive compensation, stock options, and trusts and estates.

Mr. Sherman is a well known lecturer and chairs the New York University's Summer Institute in Taxation's Introductory and Advanced International Tax Seminars, and its Institute on Federal Taxation International Tax Program. Mr. Sherman is also an adjunct professor of Tax Law at the University of Miami, Graduate Tax Program. He is admitted to practice in New York and Florida and has served on numerous panels with The Florida Bar and the American Bar Association, where he is the immediate past chair of the American Bar Association's Tax Section Committee on U.S. Activities of Foreigners and Tax Treaties.

Mr. Sherman is a well known lecturer and chairs the New York University's Summer Institute in Taxation's Introductory and Advanced International Tax Seminars, and its Institute on Federal Taxation International Tax Program. Mr. Sherman is also an adjunct professor of Tax Law at the University of Miami, Graduate Tax Program. He is admitted to practice in New York and Florida and has served on numerous panels with The Florida Bar and the American Bar Association, where he is the immediate past chair of the American Bar Association's Tax Section Committee on U.S. Activities of Foreigners and Tax Treaties.

Overview

Fort Lauderdale, Florida

- Brooklyn Law School, J.D.

- Florida, The Florida Bar

- New York, New York State Bar Association

- American Bar Association - Member

- American College of Tax Counsel - Fellow

- International Fiscal Association - Member

- New York State Bar Association, Tax Law Section - Member

- New York University's Institute on Federal Taxation - Advisory Board Member

- The Florida Bar, Tax Law Section - Member

Fort Lauderdale, Florida

- Florida, The Florida Bar

- New York, New York State Bar Association

- American Bar Association - Member

- American College of Tax Counsel - Fellow

- International Fiscal Association - Member

- New York State Bar Association, Tax Law Section - Member

- New York University's Institute on Federal Taxation - Advisory Board Member

- The Florida Bar, Tax Law Section - Member

- Brooklyn Law School, J.D.

Client Testimonials

Awards & Focus

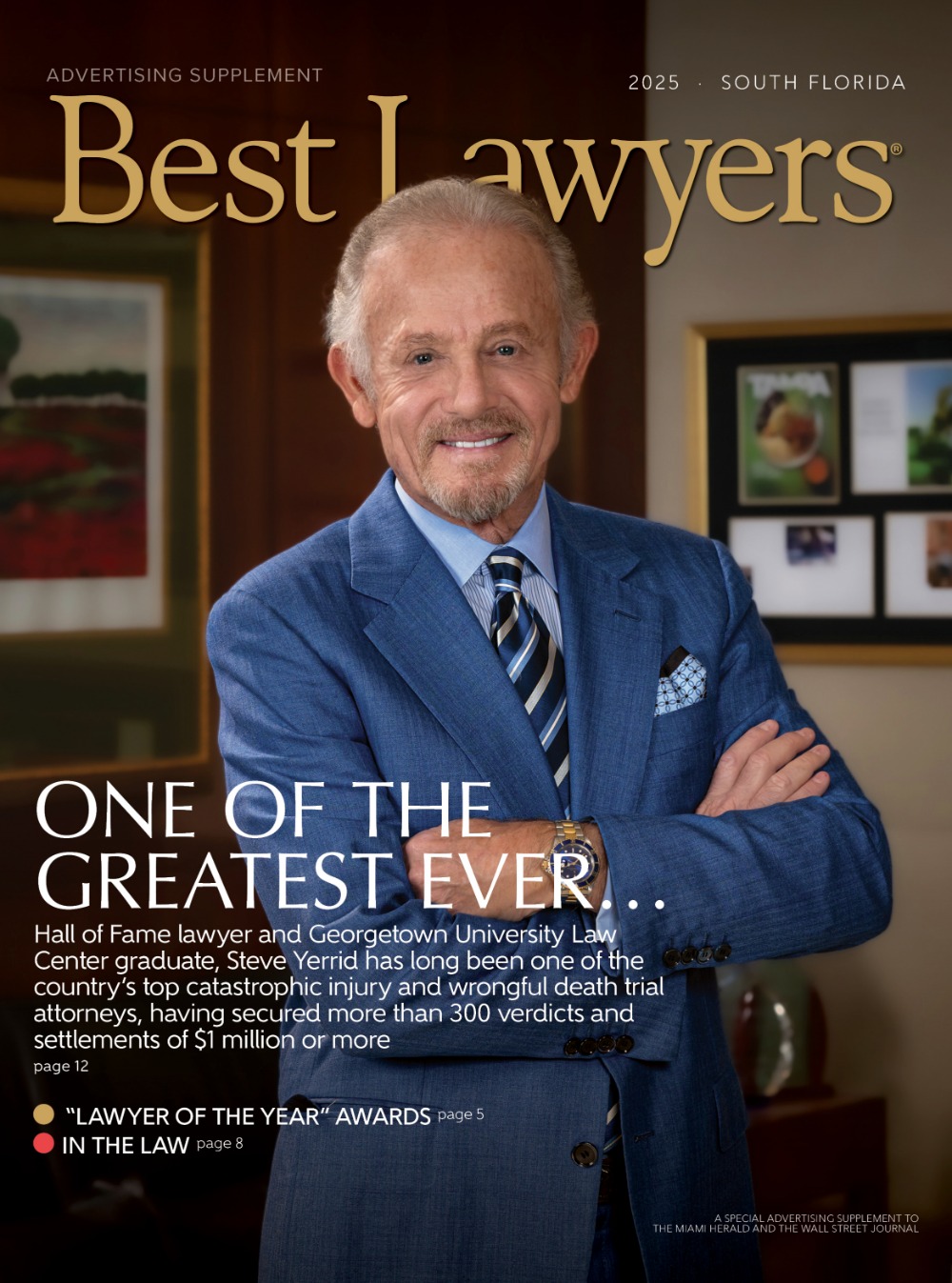

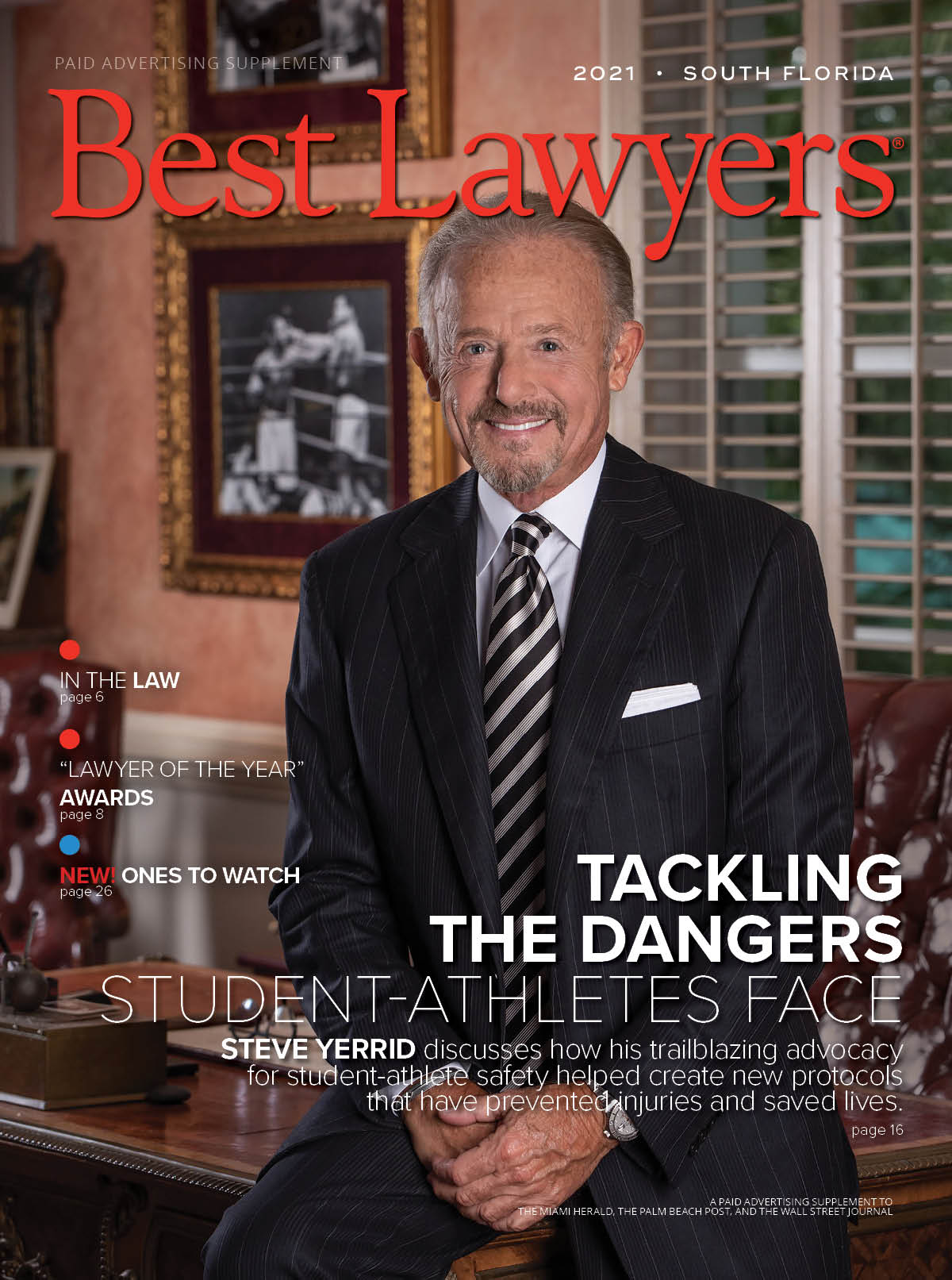

Named "Lawyer of the Year" by Best Lawyers® for:

- Litigation and Controversy - Tax, Fort Lauderdale (2020)

Recognized in The Best Lawyers in America® 2026 for work in:

- Closely Held Companies and Family Businesses Law

- Litigation and Controversy - Tax

- Tax Law

Special Focus:

- Tax

Awards:

- Martindale-Hubbell AV Preeminent Peer Review Rated

- Chambers USA – America's Leading Business Lawyers guide, Tax, 2009-2016

- Florida Super Lawyers magazine, 2015, 2016

News & Media

Publications

Your browser is not fully compatible with our automatic printer friendly formatting.

Please use the print button to print this profile page.