Twice this year—in March and May—President Trump issued proclamations imposing tariffs on American imports of steel (a 25 percent levy) and aluminum (10 percent). Initially, these charges applied only narrowly, but they’ve since been extended to nearly every country with which the U.S. trades.

Also this spring, Trump imposed a 25 percent tariff on a variety of Chinese products, part of a measure to penalize China for its trade practices; as the year has progressed, more Chinese goods have been added.

Most recently, on September 24 the Office of the United States Trade Representative (USTR), at the president’s direction, released a list of roughly $200 billion worth of Chinese imports subject to still more tariffs. They went into effect immediately at 10 percent but will jump to 25 percent on January 1, 2019.

On September 17, a week before, the U.S. Department of Commerce had announced the preliminary determination of its countervailing-duty investigation of the import of Chinese quartz surface products, noting that exporters received subsidies ranging from 34.4 to 178.5 percent. Commerce therefore instructed U.S. Customs and Border Protection to collect cash deposits from importers of these goods; it is scheduled to issue a final determination next January 28.

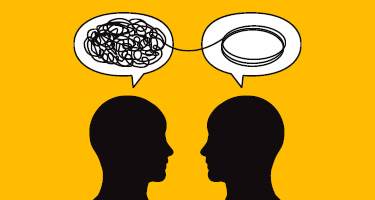

The construction industry, like any other, is greatly affected by commodity price fluctuations. Typical supply-and-demand cost adjustments are to be expected, and construction companies have a number of mechanisms to deal with them. The imposition of tariffs, however, cannot be planned for, because it represents direct government intervention that makes a nearly immediate impact on the price of the targeted goods. How can the industry cope?

Of prime importance, as contractors and subcontractors enter into new contracts, is to negotiate an appropriate “tariff clause,” or price-escalation provision, that counteracts the effects of such levies. For existing contracts without safety valves, however, recovery is a greater challenge, given that price increases sparked by tariffs are typically part of the contractor’s accepted risk inherent to lump-sum or guaranteed-maximum price contracting. Tariffs’ very nature, though, means some potential avenues for relief nonetheless remain.

Tax Provisions

Construction contracts may contain a provision allowing for recovery because of newly implemented taxes. The Federal Acquisition Regulation (FAR), for example, is incorporated into many federal procurement contracts, and FAR 52.229-3(c) specifically provides that “the contract price shall be increased by the amount of any after-imposed Federal tax, provided the contractor warrants in writing that no amount for such newly imposed Federal excise tax or duty or rate increase was included in the contract price, as a contingency reserve or otherwise.”

Similarly, Section 3.6 of the American Institute of Architects AIA A201 (2017) General Conditions of the Contract for Construction states that “[t]he Contractor shall pay sales, consumer, use, and similar taxes for the Work provided by the Contractor that are legally enacted when bids are received or negotiations concluded, whether or not yet effective or merely scheduled to go into effect.” Under this provision, arguably, if a contractor remains obligated only to pay taxes that are legally enacted when bids are received or negotiations concluded, it is not obligated to pay any such taxes that emerge after the fact—such as Trump’s recent tariffs. In these circumstances, the contractor may be able to shift the burden of the new taxes to the project owner.

Force Majeure

Force-majeure clauses in construction contracts are another means of recovery for tariffs’ price increases, but relief will largely depend on the terms negotiated for force majeure itself.

Generally speaking, the concept refers to an unexpected event that prevents someone from doing or completing a task he or she had agreed to perform, and may excuse the party from having to do so altogether. Many standard construction agreements limit force-majeure recovery merely to an extension of the contract time—and while an extension might help, it certainly won’t solve the price disparities the tariffs impose.

Instead, provided an appropriate force-majeure provision exists, a contractor may be able to argue that its performance should be excused entirely. To succeed under this theory, however, the contractor would be required to prove that the cost increases made performance impossible or commercially impracticable.

Delay Damages

Another means of recovery may be a contract provision entitling a contractor to damages because of an owner-caused delay. This requires the contractor to prove that the owner’s delay in design or material selection prevented the contractor from timely ordering of materials—which got more expensive in the interim once tariffs were imposed. A claim of this sort will necessitate a detailed review of project schedules and an assessment of when materials should (or could) have been ordered.

Other Provisions

Frequently, construction contracts contain provisions that shift risk to other parties (including subcontractors), and these should also be examined to determine whether another party ought to bear the risk of price increases spurred by tariffs. From a practical standpoint, though, in some cases the increases are so significant that enforcement of these terms might lead to a host of other issues, including failed performance.

Ultimately, the starting point for any lawyer should be the negotiation and inclusion of an appropriate price-escalation clause that contemplates price increases resulting from tariffs—but if this is not an option, or if the contract has already been executed, a close look at other provisions may provide avenues for recovery or for excused performance.

-----------

Warren E. Friedman focuses his practice on construction law and real estate counseling and litigation. He places particular emphasis on providing strategic business counseling to his clients designed to prevent costly disputes before they arise. However, when disputes do arise, Mr. Friedman’s extensive litigation experience ensures a cost-effective and aggressive solution. His clients include contractors, construction managers, owner/developers, institutions, lenders, and sureties on both private and public projects. Mr. Friedman also has extensive experience with licensure issues, surety relations, negotiating and drafting various contract documents, monitoring the construction process during construction, regulatory compliance, and counseling clients through project administration.