- Find a Lawyer

- /

- Canada

- /

- Tax Law

- /

- Ontario

Find Lawyers in Ontario, Canada for Tax Law

Practice Area Overview

Canada has a relatively high (tax) rate system. This sees aggregate federal and provincial rates of up to 32% for corporations – but with many provinces moving toward a combined rate of 25% next year or the year after. For individuals, rates go up to 50%.

The system provides constant opportunities for law firms to advise clients in either a proactive fashion – that is structuring transactions from the tax standpoint – or a protectionist, reactive fashion – that is responding to and opposing government tax claims which are considered to be unfounded or otherwise objectionable.

Undoubtedly the most exciting, difficult and complex tax advice and service requirements pertain to merger and acquisitions, in particular where the deal has a cross-border, international element, either "outbound" or "inbound." The tax planning for any of the parties (whether acquirer or target) in respect of target-related disposition gains or go forward taxation of the target provide tax practitioners with a wide scope to bring creative solutions to client needs.

International M&A often brings into play, as part of a law firm's integrated and proactive tax law services, the most controversial, contentious, and fact-intensive aspect of international tax practice, namely the field of pricing cross-border intercompany sale of goods, provision of services, licensing (or other transfers) of intangibles, and group financing-through loans or guarantees. Such "transfer pricing" issues also arise in the on-going operations of MNEs or in relation to non-M&A investment and expansion.

The foregoing should not be seen as negating the challenging Canadian tax practice assignments and mandates that arise in the purely domestic business transaction (including M&A) context.

Ray Adlington is an experienced lawyer well versed in all areas of tax law. He has a robust practice with particular focus on corporate tax, commodity tax, and tax dispute resolution with the Canada Revenue Agency on behalf of taxpayers. Ray is a past four-year member of the joint Canadian Bar Association – CPA Canada Joint Committee on Taxation tasked with advising the Department of Finance (Canada) on tax policy and legislative drafting matters. He acts as counsel to private and publi...

Peter is qualified as a CPA CA and a lawyer and has been practising as a tax lawyer/accountant for over 20 years. Prior to pursuing his law degree, Peter worked as a senior tax auditor at the CRA where he audited companies with up to $1 billion in revenue. His experience provides special insight and diverse skills for helping clients in tax planning and representation matters. Peter has assisted clients with a broad range of tax planning engagements involving domestic and international struct...

Maureen Berry’s practice is focused on wills, estate planning, domestic and international trusts, private corporation taxation, and executive compensation. Maureen also advises charities and non-profit organizations. Working with Canadian and international families, firms, corporations and charitable organizations, she provides advice on all aspects of private client matters, including inter vivos trust and will planning, post-mortem planning, donation planning, as well as succession pl...

John Campbell practises taxation law, advising clients on domestic and international income tax issues, with a focus on advising Canadian clients with international interests and non-Canadian clients with Canadian interests. John has extensive experience with respect to the tax implications and structuring of corporate reorganizations, mergers and acquisitions, international tax planning and tax planning using trusts. He provides his clients with effective, practical tax advice based on his e...

Brian R. Carr, LLB is of Counsel in Thorsteinssons’ Toronto office. He holds a B.Sc. (1970) and an LL.B. (1973) from the University of Toronto. Mr. Carr is a former Chair of the Canadian Tax Foundation, a Past-Chair of the National Taxation Law Section of the Canadian Bar Association and former Co-Chair and Member of the CBA/CICA Joint Committee on Taxation. He is a Past-Chair of the legislative subcommittee of the Taxation Section of the Ontario Bar Association. He is currently Co-Chai...

Paul Casuccio is the Leader of the firm’s Global Commodity Tax & VAT practice group. He works exclusively in this area, providing practical solutions to client’s indirect tax questions, issues, problems and structures. Paul is a sought after expert in Canada's goods and services tax and harmonized sales tax (GST/HST), provincial sales taxes, employer health tax, land transfer taxes, as well as fuel, carbon, alcohol, tobacco and other indirect taxes. Assisting clients with indi...

David W. Chodikoff, B.A. (Spec. Hons), M.A., LL.B., is a partner and specializes in civil and criminal tax litigation at Miller Thomson. David was a former counsel and a Crown Prosecutor at the Department of Justice. He has over 100 reported decisions. David has appeared in over 565 cases before the courts. David has been recognized by Canadian, American and European authorities as one of the leading tax controversy leaders in the world. He has edited and contributed to 9 tax books including ...

Brian Cohen is a partner and lawyer in Gowling WLG’s global Private Client Services Group. Based in Toronto, he assists clients in the areas of estate planning, trusts and personal taxation, with a focus on advising high net worth individuals on succession planning alternatives. Brian also advises donors, charitable organizations, public and private foundations, and not-for-profit organizations regarding the tax implications of formation, registration, governance and planned giving stra...

A partner in Fasken's Toronto office, Timothy Fitzsimmons brings extensive experience in Canadian and international income tax and commodity tax, with areas of focus in audit defence, objections, litigation, appeals and dispute resolution. His practice supports a variety of industries including financial services, cryptocurrency, real estate, aviation, natural resources, transportation, health care, communications and manufacturing. Timothy helps clients identify and manage domestic and globa...

Paul Gibney is a partner and practices in the firm’s Toronto office. Paul’s practice focuses on personal, corporate and trust planning for high net worth individuals, family offices, executives, owner-managers and their businesses, both domestic and international, including: corporate reorganizations; estate planning; purchases and sales of businesses; immigration and emigration; non-profit organizations and charities. Paul also represents taxpayers in their dealings with the CRA ...

Robert Hayhoe is a leading adviser in the charities and non-profit sector in Canada. Certified by the Law Society of Ontario as a specialist in Tax Law, Robert provides both general counsel and specialized tax advice to charities and not-for-profit organizations across Canada. Robert advises clients on the tax law governing charitable registration and non-profit status. He has experienced dealing with the complex law governing foreign expenditures and activities by Canadian charities, and wit...

M. Elena Hoffstein, FEA, has a practice focused in all areas of estate planning, family business succession planning, corporate reorganization both pre and post mortem planning. She also advises on cross border and international matters, will, trusts and marriage contracts. Elena is also a recognized leader in charity law advising both charities and donors on effective legislative, tax and regulatory matters and on tax effective charitable gifting. Elena frequently advises clients on family b...

Vince Imerti is a partner in the Real Estate, Corporate and Tax Groups. Vince has led teams in a number of complex and large acquisitions, mergers, reorganizations, debt restructurings, financings and derivative transactions. His practice focuses on domestic and cross-border corporate, trust and partnership investment matters particularly in the alternative asset space. He has extensive experience forming funds and structuring, negotiating and implementing direct and indirect real estate, inf...

Joan is a Partner in Minden Gross LLP's Tax Group and has extensive experience in domestic and international tax planning. Both highly detailed and experienced, Joan has the unique ability to see the big picture while drilling down to the finest points of a client's needs. Joan chose tax as her specialty for its analytical nature. In tax, the rules are always changing and Joan really enjoys the challenge of keeping up-to-date. Joan is a frequent lecturer for professional and commercial organi...

Greg Kanargelidis has more than 30 years of experience practicing in the areas of customs, international trade, and commodity tax law. In 2022 Greg opened his own law practice after a rewarding career at a large full-service firm based in Toronto, Ontario, the last 26 years as a partner and head of the firm’s International Trade Group. Greg is recognized as one of the leading international trade and customs lawyers in Canada and the world. Greg has extensive experience representing Cana...

Lesley Kim practices in the areas of domestic and international tax law and has particular experience with outbound cross-border transactions involving foreign affiliates and non-resident trusts. She works extensively with public and private corporations and private equity groups undertaking mergers and acquisitions, spin-offs, plan of arrangements, financings, including flow-through share offerings and IPOs, and other corporate reorganizations, including for estate planning purposes. Lesley ...

Dean Kraus is a partner in the Tax Group. His practice encompasses all aspects of income taxation in corporate and commercial transactions, including domestic and cross-border mergers and acquisitions, corporate reorganizations, spin-offs, private equity investments, financings, REITs, partnerships and joint ventures. Dean’s expertise has been recognized by Chambers Canada , Chambers Global , The Canadian Legal Lexpert Directory , The Best Lawyers in Canada , among others.

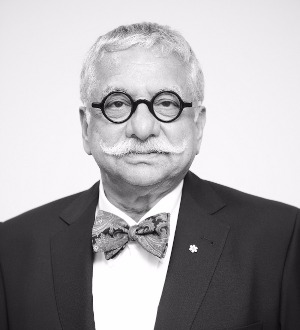

Vern Krishna is Tax Counsel at TaxChambers LLP and Professor of Common Law at the University of Ottawa. Professor Krishna is a national expert in the area of tax, the author of over fifteen texts in tax, international tax, business law, numerous articles and case comments. His work is often cited by the Supreme Court of Canada. Professor Krishna's practice is comprised of tax litigation and dispute resolution, international tax, tax planning and wealth management. He acts as counsel in income...

Kyle is a partner practicing in the firm’s Toronto office. Kyle’s practice focuses on Canadian tax planning for businesses, individuals, and trusts, with a particular emphasis on owner-managed businesses, cross-border issues, high net worth families, and professionals. He advises on all aspects of domestic and international tax law, including corporate structuring and reorganizations, private wealth and estate planning, business succession planning, immigration/emigration, purchas...

John J. Lennard is a partner in the Tax Group. He works closely with leading private and public companies, as well as pension funds, sovereign wealth funds, private equity firms and Crown corporations on corporate reorganizations, mergers and acquisitions, investment fund formation, and corporate finance matters. He frequently consults on cross-border transactions, structuring non-resident investment into Canada and outbound investment by Canadian multinationals. John also advises high-net-wo...

John Lorito is Head of the Tax Group and a member of the firm’s Partnership Board. His practice focuses on tax elements of corporation transactions, with particular emphasis on corporate reorganizations, mergers and acquisitions in domestic and cross-border transactions, investment funds, corporate joint ventures, REITs, corporate finance and international taxation. John regularly represents clients across various industries, including financial services, real estate, telecommunications...

Jenny P. Mboutsiadis is an expert tax litigator with over two decades of trial experience as lead counsel. She has extensive successful experience arguing tax cases in the Tax Court of Canada, the Ontario Superior Court of Justice, the Federal Court, and the Federal Court of Appeal. Jenny provides clients with exceptional knowledge on resolving tax disputes with Canadian tax authorities, from the start of a tax audit to trial. She has expertise in corporate tax matters, including transfer pri...

Margaret Nixon is a partner in the Tax Group practising in the areas of tax controversy and tax litigation. She represents corporations and individuals in tax disputes with the Canada Revenue Agency and provincial tax authorities, and has successfully represented clients at the audit and appeals levels and in litigation proceedings in the Tax Court of Canada, the Federal Court of Appeal, the Federal Court and the Ontario Superior Court of Justice. Margaret has experience resolving disputes in...

Ron Nobrega’s practice is focused on domestic and international corporate taxation, including mergers, acquisitions, financings, divestitures, reorganizations and international tax planning. Ron works with issuers and underwriters in debt and equity offerings. He regularly works with clients in diverse industries in planning Canadian and international investments and business expansions. He frequently advises on the application of tax rules relating to foreign affiliates, offshore inves...

John O'Connor is a partner in the Tax Group. John's practice involves all areas of corporate tax, focusing primarily on complex mergers, acquisitions and reorganizations, along with advising tax-exempt entities. In addition, John regularly consults on a variety of technical tax matters.

Adrienne Oliver’s practice involves all aspects of tax planning and implementation, primarily in the corporate tax field. She has participated in structuring major public and private transactions, reorganizations and financings, and has also acquired significant experience in international tax planning and public capital market transactions. Ms. Oliver has acted for clients in a diverse range of industries, including some of Canada’s most respected corporations. She has recently a...

Alex's practice focuses on Canadian tax issues that affect multinationals with operations in Canada, including international tax planning (inbound structuring, transfer pricing, foreign affiliate taxation, cross-border employee mobility, withholding tax, tax treaty issues), M&A, reorganizations and financings. Alex is both a lawyer and a Chartered Professional Accountant. Alex advises clients in the digital economy, infrastructure, resource, healthcare, consumer product and retail spaces....

Known for her strategic approach, honed advocacy skills, and breadth of tax knowledge, Becky Potter is a highly sought-after tax litigation partner at Thorsteinssons LLP. She has successfully represented her clients at every level of court both provincially and federally, including a landmark win at the Supreme Court of Canada. In addition to her in-court experience, she has extensive out-of-court experience negotiating favourable settlements for her clients. Becky is an active member of the ...

Biography Emmanuel Sala is a partner in Baker McKenzie's North American Tax Practice Group in Toronto. He has broad experience advising Canadian and foreign companies on complex domestic and international tax matters with respect to mergers, tax reorganizations, financing transactions and acquisitions. He also represents taxpayers at all stages of tax disputes with the Canadian tax authorities. Since 2012, Emmanuel has been teaching at the Master of Laws (taxation) program jointly sponsored b...

Barry Segal is a tax lawyer in our Toronto office. He has a diverse tax practice that includes public and private M&A, debt restructurings, corporate finance, corporate reorganizations, structuring private equity investments, advising domestic and cross-border investment funds, and international tax planning for Canadian and foreign corporations. Barry also acts as counsel on federal and provincial tax audits and appeals.

Christopher Steeves is the Leader of the firm’s Tax group. Frequently advising Canadian businesses in corporate restructurings and acquisitions, Christopher also assists with income tax aspects of complex domestic and cross-border financings, and financial instruments including derivatives, securities lending and collective investment funds. With expertise in transfer pricing and the resolution of disputes with Canadian tax authorities, Christopher has worked with clients and advisors o...

David Stevens is partner in the business law department in the Gowling WLG Toronto office. David is a tax lawyer, focussing on corporate and international tax planning, personal and private company tax planning, trust taxation, charities and not-for-profits, and mining. David's clients include high net worth individuals and their families, regsitered charities, not-for-profit organizations, and trust companies. David advises clients on business succession planning, estate planning and estate ...

Corina Weigl is Co-Leader of the Private Client Service group. Her practice is focused on estate and family business succession planning. She develops customized strategies for wills, trusts, and tools designed to protect a client's property, such as domestic contracts, Corina leverages legal and tax regimes to protect multi-jurisdictional property and family interests. She is also active in the Firm, currently holding the position of Chair of the Firm’s Professional Development Committ...

Matthew Williams is a partner and practices in the firm’s Toronto office. Matthew’s practice focuses on all aspects of taxpayer representation. He has appeared before the Tax Court of Canada, the Federal Court of Canada, the Federal Court of Appeal, the Ontario Superior Court and the Supreme Court of Canada on a wide range of issues. Matthew has extensive experience dealing with Canada’s general anti-avoidance rule (GAAR) in both domestic and international contexts having su...

Jonathan Willson is a partner in the Tax Group. His practice focuses on all areas of Canadian income tax law, including domestic, cross-border and international mergers and acquisitions, corporate reorganizations and restructurings, corporate finance, and investment fund structuring. Jonathan’s clients include publicly listed and private Canadian, U.S. and global entities across various industries, including financial services, real estate, mining, technology, and healthcare. He has bee...

Kevin Yip has a broad income tax practice with expertise in all aspects of domestic and international tax planning, corporate reorganizations, and mergers and acquisitions. Kevin also regularly assists clients in transfer pricing, real estate transactions, corporate financing and executive compensation plans. Kevin regularly advises clients on cross-border transactions and has experience advising investment funds, banks, insurance companies, and technology companies structure investments into...

Biography Andrew Boyd is a partner in Baker McKenzie's Tax Practice Group in Toronto. His practice focuses on tax litigation and dispute resolution. Andrew is also an active member of the tax community, having served on the Steering Committee of the Canadian Tax Foundation’s Young Practitioner’s Group (Toronto) for four years, during which time he organized and moderated presentations on topics such as rectification, developments in GAAR jurisprudence, responding to audits, the ch...

Biography Shereen Cook is an associate in Baker McKenzie's Tax Practice Group in Toronto. She advises Canadian and foreign taxpayers in the areas of tax planning, tax structuring, tax reorganizations and mergers and acquisitions, as well as domestic and cross-border financing. She also represents taxpayers in tax disputes with the Canadian federal and provincial (Quebec) tax authorities. Shereen also serves as an adjunct professor of law at HEC Montreal/University of Montreal, where she teach...

Pritika Deepak advises clients on a variety of issues pertaining to wealth management, estate and family planning. As a part of her practice, Pritika assists clients in developing tax-effective plans to allow for an orderly and efficient transfer of wealth in accordance with clients' wishes. Pritika regularly prepares documents relevant to estate planning and administration, corporate reorganizations, including estate freezes, domestic and cross-border wills, trusts and powers of attorney. Pr...

Michael Ding is an Associate in the Tax Group at WeirFoulds LLP with a practice that focuses on various areas of domestic and international taxation planning, advice, and dispute resolution. Prior to joining WeirFoulds, Michael practised as Counsel at the Department of Justice Canada, representing the Crown before the Tax Court of Canada, Federal Court of Canada, Ontario Superior Court of Justice and the Court of Appeal for Ontario. Michael has experience in advising on various tax and disput...

Brittany is an associate in Koskie Minsky’s Pension and Employee Benefits Group, specializing in Pension Fund Investments. Brittany’s practice involves advising pension and other benefit funds with respect to their investments, both in the traditional and alternative asset classes. She also has experience advising pension and other benefit funds to ensure their investments are compliant with Canadian and provincial pension legislation. Brittany frequently negotiates on behalf of c...

Biography Bryan Horrigan is a partner in Baker McKenzie's Tax Practice Group in Toronto. Prior to joining the Firm in 2018, Bryan was a lawyer with a boutique tax law firm in Toronto, providing advice on indirect tax and trade matters in both planning and dispute resolution contexts. He started his career as an articling student and associate at a national law firm. Practice Focus Bryan's practice is focused on Canadian Goods and Services Tax (GST)/Harmonized Sales Tax (HST), provincial sales...

Ashley Rasmussen is an associate in the Tax Group. Her practice focuses on domestic and cross-border mergers and acquisitions, corporate reorganization transactions, private equity investments, and executive compensation. She has experience working with clients in various industries, including mining, hospitality, quick-service restaurant, technology, entertainment, sports, real estate, and insurance. She has published articles and presented on various tax topics.

Our Methodology

Recognition by Best Lawyers is based entirely on peer review. Our methodology is designed to capture, as accurately as possible, the consensus opinion of leading lawyers about the professional abilities of their colleagues within the same geographical area and legal practice area.

The Process

Best Lawyers employs a sophisticated, conscientious, rational, and transparent survey process designed to elicit meaningful and substantive evaluations of the quality of legal services. Our belief has always been that the quality of a peer review survey is directly related to the quality of the voters.